Futures Contracts Calculator

The outstanding futures contract calculator helps you determine your profit or loss, whether you are long or short in the futures market. This article will cover what a futures contract is, how futures contracts work, and explore a real-life transaction. As a bonus, we'll compare forward vs. future contracts and futures contracts vs. options.

We'll begin at the beginning and discuss the definition of futures contracts.

What is a futures contract? Definition

A futures contract is a legal agreement of asset delivery between two parties put together by an exchange (e.g., CBOE, CME, NYMEX, etc.). Buyers and sellers lock in prices for a physical transaction that will occur at a predefined date in the future. The futures contract specifies the quality and quantity of the asset. It also indicates location and delivery time.

Future contracts are beneficial for companies/factories that want to make agreements at specific commodity prices, avoiding market price fluctuations until delivery in the future.

Let's see an example of a futures contract: An airline company wants to acquire thousands of oil barrels but does not want future oil price fluctuations to affect their margins. As a solution, they can get an oil futures contract with a specific buying price to reduce their risk.

Besides, because the futures exchange regulates the contract, it reduces counterparty risk. In other words, the exchange assumes the buyer's risk of not having money for paying for the goods.

Investors and companies can invest in a wide range of assets in the futures market aside from commodities. You can trade bitcoin, bonds, currencies, among others.

Similar to call and put options, we need a buyer and a seller, or the one who is "long" and the one who is "short", accordingly to the investing slang. We are going to explain their roles in the next section. If you are considering the stock market will rise, you could check how much you can gain with the call option calculator.

How do futures contracts work?

Unlike stocks, which you buy on a particular day and can forget about, a futures contract has an expiration day and asset delivery date. Until that moment, the exchange is in charge of taking into account price fluctuations and their effect on participants money balance:

-

If the underlying asset price increases, the exchange debits money from the seller's account and puts it into the buyer's accounts.

-

If the underlying asset price decreases, the exchange debits money from the buyer's account and puts it into the buyer's account.

Everyday futures market exchanges do this balancing operation. But what about the risk of not having enough money to pay the other party?

If one of the participants is close to not having enough funds to cover the balancing operation, the exchange calls them and requests they put more funds into the account. If the participant fails to comply, the exchange closes the position, taking all the necessary funds to make the settlement. People named that call: the margin call.

Our future contracts calculator helps you determine the daily amount of money the exchange transfers between the participants based on contracts trading specifications.

What are the future contracts trading specifications?

To negotiate future contracts, we have to understand its components:

-

Future contract trading code: Refers to the contract exchange code. For example, the E-Mini S&P 500 Futures Contract has the trading code ES.

-

Future contract month code and year: It is a combination of a letter and a number that indicates the month and year of contract expiration. "H22" refers to a contract expiring on March 22.

-

Contract size: Indicates the exact deliverable quantity of the asset, which could be barrels of oil, ounces of gold, or cash if the contract refers to a financial asset.

-

Tick value ()and tick size: Minimum price fluctuation of the contract's price. The exchange defines the tick value. For example, the ESH22 contract (E-Mini S&P 500 Futures Contract with expiration at March 22) has a tick size of 0.25 and a tick value of 12.5 USD.

-

Point value (): If the tick value represents the minimum price fluctuation to the right of the decimal point, the point value represents the same but to the left side of the decimal point.

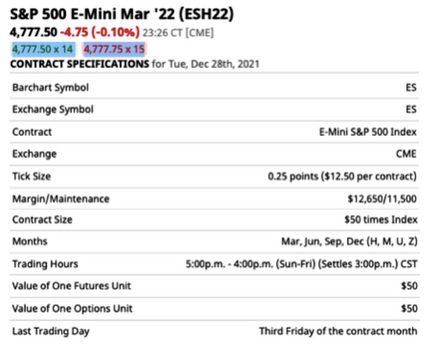

Check the following picture to understand the terminology in our nifty futures contract calculator.

Here you can see:

- Trading code, including the expiration date: ESH22;

- Contract size: 50 times the value of the index (50 × 4777.50 = 238,875 USD);

- Tick size and tick value: 0.25 points (12.50 USD); and

- Point value: If 0.25 points value 12.50 USD, a point values 50 USD.

Furthermore, notice that today, the contract has a decrease in value of 4.75 points or 19 ticks (19 × 0.25 = 4.75 points).

How to profit? – A futures contract example

Continuing with the example above, if the contract has a decrease in value of 19 ticks and each one values 12.5 USD, the long position holder (contract buyer) has lost:

However, this is the seller's profit, assuming they only have one contract.

You can input the same info in our handy futures contracts calculator and compare it yourself. The formulas we used are:

where:

- — Point value;

- — Tick value;

- — Number of ticks per point;

- — Profit or loss for buyer;

- — Number of contracts; and

- — Number of points moved.

On the other hand, if you want to determine the number of points at a specific selling price, you use:

where:

- — Selling contract price

- — Buying contract price

Finally, to determine the profit or loss for the seller of the futures contract, you use:

where:

- — Profit/loss for seller; and

- — Profit/loss for buyer.

We will explain another futures contract example with the above oil futures contract: The Crude Oil WTI Feb '22 (CLG22). From the we see:

if the contract has 1000 barrels, then:

, and

.

Today, we see the Crude Oil WTI Feb '22(CLG22) is trading at 75.82 with an increment of 0.25 points so far. Assuming we have five contracts:

How to use our futures contracts calculator for drawdown protection

If you have a portfolio with a high beta, verify it with our portfolio beta calculator, you can consider starting a short position in a stock market index futures contract. Let me explain.

Notice we could have earned money if we were the buyers in the E-Mini S&P 500 Futures Contract when the index increased in value. In the opposite case, when E-Mini loses value, the buyer loses money, and the seller gets that as a profit.

Suppose the stock market crashes, and the index falls in value, impacting its futures market contract. In that case, if you are short, you profit even though your stock portfolio is losing money. Such profits from the futures markets can help offset the loss, reducing the overall losses or even making you net profits. We recommend experimenting with the maximum drawdown calculator for finding out how much you have to recover in case you loose money in the stock market.

As a final note, investors consider buying gold futures contracts as an excellent way to protect themselves against market crashes.

FAQs

What is the futures contract definition?

A futures contract is a financial instrument that allows participants to take or reduce risk against an asset's price fluctuation. The agreement includes the delivery of an asset at a predefined price, regardless of the current asset market price on the day of delivery. An example would be a semiconductor factory that acquires a long position in a gold futures contract because it expects the mineral's price to increase.

What are the differences between futures contracts vs. options?

We will mention two main differences:

- Futures contracts involve delivering standardized assets where quality and quantity are ensured; meanwhile, options give the right but not the obligation to buy or sell stocks at different prices than the market.

- Futures contracts give exposure to a broader range of assets than options. Some of them are metal commodities, oil, and agricultural goods. Options only provide exposure to stocks and indexes.

What are the futures contract month codes?

Here is a table of the futures contract month codes:

Month | Code |

|---|---|

January | F |

February | G |

March | H |

April | J |

May | K |

June | M |

July | N |

August | Q |

September | U |

October | V |

November | X |

December | Z |

What are the differences between forwards vs. futures contracts?

Let's explore two main differences:

-

Future contracts are legal agreements of delivery of a standardized asset. The futures exchange market ensures quality and quantity when creating the contract.

-

Forward contracts are also agreements of delivery of assets between two private parties. They trade it over-the-counter; consequently, there is no third-party entity to verify quality and quantity as with future contracts.

How do I estimate the profits of my futures contract?

To calculate the profits of your futures contract:

-

First, identify the tick value and how many ticks the contract moved.

-

Considering the number of future contracts you have, multiply the tick value times how many ticks the contract value moved times the number of contracts you have.

-

The result will be a profit or loss, depending on whether the contract value went up or down and whether you were long or short.