The dividend payout ratio calculator is a fast tool that indicates how likely it is for a company to keep paying the current dividend level. In this article, we will cover what the dividend payout ratio is, how to calculate it, what is a good dividend payout ratio, and, as usual, we will cover an example of a real company.

What is the dividend payout ratio?

The dividend payout ratio is a financial indicator that shows how much of the net income is given back to the stockholders in terms of dividends. The result is expressed as a percentage. A closer value to 100% means the company pays all of its net income as dividends. A value closer to 0% indicates little dividend relative to the money the company is earning.

It is important to mention that the dividend payout ratio calculator differs from the dividend calculator. The former is a performance indicator that reflects the dividend profitability of holding the stock; meanwhile, the latter shows how much return on investment the dividend yields. Remember that we can earn on the stock market by receiving dividends and by trading stocks at different prices.

How do you calculate the dividend payout ratio?

To calculate the dividend payout ratio, follow these steps:

-

Find the net income within the income statement.

-

Find the total dividends in the financing activities section of the cash flow statement.

-

Divide the total dividends by the net income to get the dividend payout ratio (DPR):

DPR = total dividends / net income.

There is another way to calculate this ratio, and it is by using the per-share information. Here you should look for the diluted EPS in the income statement. Then you will need the declared dividend per share that can be found .

In case you cannot find the diluted EPS, you might try using the net income available to the common stockholders and divide it by the average diluted shares outstanding.

As you can imagine, the dividend payout ratio formula is the same, just expressed in per-share terms:

where:

-

— Dividend payout ratio the company pays per share;

-

— Declared dividend per share the company registered;

-

— Earnings per share, including all the outstanding shares (this is why it is called diluted);

-

— Net income that belongs to the stockholders (everybody that has a company share); and

-

— Average diluted shares outstanding, which includes all the possible conversions from options, warrants, and others to company shares.

Anyway, there is no reason to memorize any of these formulas because our dividend payout ratio calculator includes both. The latter can be found in the bottom part of the calculator by clicking on "Per share calculation" and "Diluted earnings per share."

What is a good dividend payout ratio?

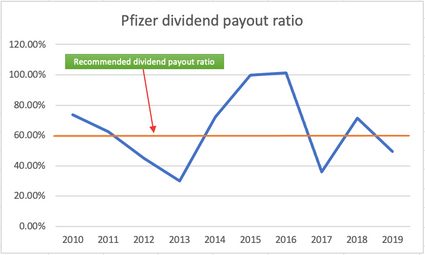

Under 60%. Several investor gurus recommend a dividend payout ratio under 60%, stating that if a company surpasses such a payout ratio, it may face future problems in holding the level of dividends.

Furthermore, we want to invest in companies with a compound annual growth rate of dividends higher than 5%. Then, our dividend payments will be covered against inflation. To perform such a calculation, check the CAGR calculator and input the dividend the company paid 5 years ago and their last yearly dividend. Then select 5 as the period. As a result, you will have the CAGR.

Besides the payout ratio and dividend criteria, we look for a company with an average return on equity (ROE) higher than 12% over the last 5 years. The ROE ratio indicates how profitable the company is relative to the equity of the stockholders. Only a profitable company will be able to sustain growing dividends for the long term.

Our incredible dividend payout ratio calculator includes specific messages that appear accordingly to the value you get for the payout ratio. For example, suppose you get a low dividend payout ratio. In that case, it will recommend you check the free cash flow calculator and find out whether the company is investing profits into expanding the company. Go there and play with several values to discover them.

Payout ratio real example: Pfizer

Pfizer (NYSE: PFE) is a leading pharmaceutical company that is currently very famous because of the COVID-19 vaccine development. Many investors have been buying the stock to get a quick profit; however, this company is one of the dividend companies beyond comparison.

In this example, we will consider the financial report to find out the dividend payout ratio. As mentioned above, we will need the cash flow statement, the income statement, and of course, our fantastic dividend payout ratio calculator. Then, we have:

We notice that during 2019, Pfizer had a dividend payout ratio under 60%. But what about the other years?

Pfizer has been paying a growing dividend during the last 40 years. Investors have seen their quarterly dividend payments grow from 0.18 USD per quarter (2010) to 0.39 USD per quarter (2020). Such growth in dividends has also come with a stock return on investment equal to 108% (2010-2020), making a total return of about 208% during the last 10 years.

One of the reasons for this steadiness and growth is the company payout ratio. It has been oscillating near the 60% level for several years already. Sometimes, the company has paid more and other years, it has paid less.

In the next image, we considered the last ten years' financial reports and took them as input for our dividend payout ratio calculator:

In conclusion, keeping an eye on how much dividends a company pays, and not only on the dividend yield, can provide extra safety of constant income. If you are interested in other financial tools besides this handy dividend payout ratio calculator, we recommend you check our complete set of investing calculators.

FAQs

Can dividend payout ratio be more than 100?

Yes, the dividend payout ratio can be above 100%. A company with a 100% or higher dividend payout ratio is paying its stakeholders all or more than it's earning. This practice may be unsustainable in the long term since the company would run out of funds.