The cash conversion cycle calculator is a wise tool that can tell you how much time it takes for the company that you are analyzing to complete its business operating cycle. In this article, we will cover the components of the cash conversion cycle formula, how to calculate it, the meaning of an increasing/decreasing and negative cash conversion cycle, and explore a real case example.

What is the cash conversion cycle?

The cash conversion cycle (CCC) represents the whole business operating process from the acquisition of raw materials until the product or service is delivered. It also covers the business stages where the company takes credit from suppliers and provides credit to clients.

All that information is covered in the financial accounts presented in the balance sheet as money items. Particularly the following ones:

-

Inventories: Defined as a current asset because of its liquidity, it represents all materials costs (raw and end produced) that are part of the core operation of the business.

-

Accounts receivables: Also considered a current asset, it includes all the payments owed by customers that acquired products or services on credit. It is not considered to be interest-bearing and is expected to be paid in less than 12 months.

-

Accounts payables: A current liability item that represents money that the company owes to suppliers. In other words, it is a debt; however, it is non-interest-bearing.

The relation between these three items represents the business operating cycle or cash conversion cycle: First, the acquisition of materials and posterior processing (inventories); second, the payment received from clients (accounts receivables); and finally, the payment to suppliers (accounts payables). With the expected profits, the cycle is expected to start again.

As we will see in the cash conversion cycle formula, the result is in days, and represents the time required for converting the referred output of cash for acquiring inventories until that cash comes back after getting paid.

It is important to mention that during the conversion cycle, the company needs financing because its cash is attached to inventories and accounts receivables, so the company cannot use it to keep running the business with activities like buying new inventories.

Cash conversion cycle formula

Now it's time to show the cash conversion cycle formula. The process is not direct and includes a total of a three-level calculation:

1st level: Main formula:

CCC = Acc_re_days + Inv_days - Acc_pay_days

where:

-

CCC– cash conversion cycle; -

Acc_re_days– accounts receivables days; -

Inv_days– inventory days; and -

Acc_pay_days– accounts payable days.

Note here that we have converted the money items mentioned in the What is the cash conversion cycle? section into days items. Continue reading to find out how.

2nd level: Components formulas:

Acc_re_days = Avg_acc_re / (rev / t)

Acc_pay_days = Avg_acc_pay / (COGS / t)

Inv_days = Avg_inv / (COGS / t)

where:

-

t– period of analysis, which can be done quarterly but preferred to be yearly because of the seasonality effect; -

rev– total revenues; -

COGS– cost of goods sold, which represents the direct production costs;

3rd level: Subcomponents:

Avg_acc_re = (Beg_acc_re + End_acc_re) / 2

Avg_acc_pay = (Beg_acc_pay + End_acc_pay) / 2

Avg_inv = (Beg_inv + End_inv) / 2

where:

-

Avg_acc_re– average accounts receivables; -

Avg_acc_pay– average accounts payable; and -

Avg_inv– average inventory.

The following beginning/ending accounting financial data depends on when the period of analysis starts/ends:

-

Beg_inv– beginning inventory; -

End_inv– end inventory; -

Beg_acc_re– beginning accounts receivables; -

End_acc_re– end accounts receivables; -

Beg_acc_pay– beginning accounts payable; and -

End_acc_pay– end accounts payable.

In summary, we get inventory and accounts receivable/payables days by finding out the average amount of money of those accounts per daily revenues and daily production costs (COGS) for obtaining the cash conversion cycle.

Though, eh? Don't worry because all of this is already inside our smart cash conversion cycle calculator.

How to calculate the cash conversion cycle?

You will find all the information required in the balance sheet and income statement. If you use annual reports, your period of analysis will be 365; otherwise, you will consider 90 days for quarterly information. Then, you just need to fill them in our fantastic cash conversion cycle calculator.

What does the cash conversion cycle tells?

The most important part of any financial ratio is how it can help us to improve our return of investment (ROI). The cash conversion cycle tells us one thing: The amount of time that company operations need to be financed. From that definition, we get two main conclusions:

-

We want to avoid companies with an increasing cash conversion cycle because it means that the business is becoming more operating inefficient, locking more and more cash into its processes.

Business efficiency deterioration can clearly impact the compound annual growth rate (CAGR) of sales; thus, hurting free cash flow. See the CAGR calculator and free cash flow calculator to learn more.

-

We prefer companies with the lowest cash conversion cycle among their peers, or if not, at least a decreasing one. A decreasing CCC represents a more efficient company that rotates its inventories faster, gets paid faster, and probably is paying its suppliers later; thus, holding cash for more time.

If the company manages to have more cash at any moment, it can purchase more inventories to sell even more and increase its EBIT.

Exceptional cases: Negative cash conversion cycle

Considering the last statement about having more available cash to improve operating cash flow, we notice that if we reduce the cash conversion cycle to zero, then the company does not need any financing. In theory, it could run infinitely just from its operations.

But what happens if we go further and get accounts payable days so big that it makes the CCC a negative value? Then, the company will be getting financed by the cash not paid to the providers, or:

Acc_re_days + Inv_days < Acc_pay_days

In such cases, the company would not need any kind of financial debt; thus, no interests to be paid. This situation put the company in a very strong position in case of economic turmoil, creating a business moat against competitors.

A clear example of a negative cash conversion cycle is Amazon, which pays its suppliers after 70-80 days; thus, obtaining a CCC even shorter than -20 days during the last year. Amazon covers all its operations with money from suppliers.

Real example of how to reduce the cash conversion cycle

Finally, we will cover a real example: Walmart. This company has one of the biggest retail businesses worldwide, and in this article, we will analyze its 2020 cash conversion cycle. It's a great lesson in how to reduce your cash conversion cycle.

For such endeavor, we need the . The data required is:

Total revenues = 523,964 million USD

Cost of goods sold = 394,605 million USD

Beginning inventory = 44,269 million USD

End inventory = 44,435 millions USD

Beginning accounts receivables = 6,283 million USD

End accounts receivables = 6,284 million USD

Beginning accounts payable = 47,070 million USD

End accounts payable = 46,973 million USD

And because we are reviewing yearly information, we will have:

Period of analysis = 365 days

Then, after using our awesome cash conversion cycle calculator, the average inventories and accounts receivables/payables are:

Average accounts payable = 47,021.5 million USD

Average accounts receivables = 6,283.5 million USD

Average inventory = 44,352 million USD

And the inventories and accounts receivables/payables days are:

Accounts receivables days = 4.4 days

Inventory days = 41 days

Accounts payable days = 43.5 days, meaning that on average, Walmart paid to its providers in 43.5 days during 2019.

Consequently, we have:

Cash conversion cycle = 1.9 days

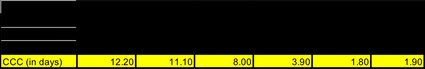

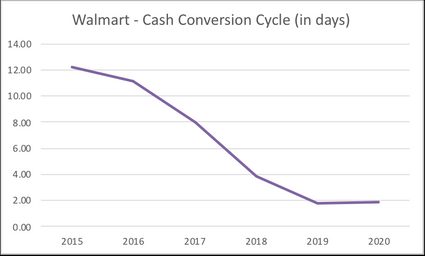

If we do the same process for the last 6 years, we get:

where:

- DSO – days sales outstanding (accounts receivables days);

- DIO – days inventory outstanding (inventory days); and

- DPO – days payable outstanding (accounts payable days).

The improvement in operational efficiency that can be seen since 2015 has made the market capitalization of Walmart recover and reach new highs while providing a stock investment return of 160% during the last 5 years.