Revenue Growth Calculator

The revenue growth calculator is an excellent tool that can give you an insight into business success. The revenue growth calculator indicates how much revenue has increased from period to period and shows how fast. In this article, we will explore what is the revenue growth formula, how to calculate revenue growth, what is the revenue growth rate, and see examples of renowned companies such as Tesla, Apple, and Amazon.

🔎 And here's a tenure calculator to help you find the average duration of service of employees in a company.

What is revenue growth?

Revenue growth refers to the increase in sales of a company between periods. Expressed as a percentage, it shows how much a company grew its revenues in one period compared to the previous period. Investors usually calculate it quarter-over-quarter (QoQ) or year-over-year (YoY).

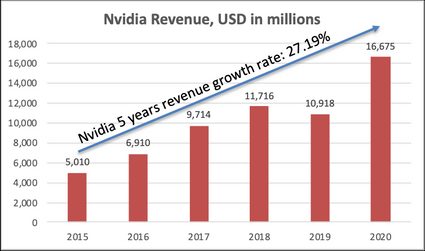

A company that achieves or reports high revenue growth will likely represent a high return on investment possibility. A quick example is Nvidia, which grew its revenue from $10,918 million USD in the fiscal year 2019 to $16,675 million USD in the fiscal year 2020, meaning a 52.73% revenue growth.

We will cover the revenue growth formula in the next paragraph, but the point here is that Nvidia's revenue growth provided a 113% stock profit during the whole of 2020.

For a better understanding, we have to remember the relation between revenue and earnings as discussed in our profit margin calculator. Such a ratio allows investors to determine which is the most profitable company in a sector or industry.

What is the revenue growth formula?

As mentioned before, the revenue growth formula describes the relationship between two numbers and expresses it as a percentage.

Revenue growth = ((Revenuefinal − Revenueinitial) / Revenueinitial) × 100%

where:

-

Revenuefinal — most recent revenue data between the two numbers to evaluate.

-

Revenueinitial — older revenue data between the two numbers to evaluate.

What is the revenue growth rate?

The revenue growth rate is the speed at which the sales or income provided by services is generated. It uses the same concept as the compound annual growth rate (CAGR), and that is why it is also known as revenue CAGR. See the CAGR calculator if you're unfamiliar with this concept.

This approach can include more years; thus, it provides a more reliable result. Besides, in a similar way to revenue growth, it can indicate business direction. For the same company mentioned above, NVIDIA, we have a revenue growth rate or revenue CAGR of 27.19% during the last five years. We will cover the formula in the following paragraphs.

Again, the main idea here is to point out that the revenues have been growing at a compound rate of 27.19% over the last five years. Please explore the compound interest definition for more details on this process of value compounding.

Such a remarkable revenue growth rate definitely affects earnings before interest, operating cash flow, and free cash flow growth, which, consequently, makes the company more valuable.

What is the revenue growth rate formula?

Regarding the revenue CAGR formula, the only required value that has not been mentioned yet is the compounding period or analysis period.

Let's say we are analyzing the example of the last paragraph: There we mentioned a growing compound rate of 27.19% over the last five years. That means revenue had five periods or, in this case, five completed years to compound and grow at that rate.

The revenue growth rate formula is as follows:

Revenue Growth rate = ((Revenuefinal / Revenueinitial)1/n − 1) × 100%

where:

n— number of periods.

In the next section, we will explore how to use this formula.

How to calculate revenue growth and revenue growth rate?

For the calculation, we invite you to use the following data in our almighty revenue growth calculator:

You can see that the reported revenue in 2019 is $10,918 million USD, and the reported revenue in 2020 is $16,675 million USD. Then, by using the revenue growth formula, we have:

Revenue growth = (16,675 − 10,918) / 10,918) × 100%

Revenue growth = 52.73%, as mentioned above.

You can try it yourself with the other data and confirm the results by using our revenue growth calculator.

Furthermore, we will calculate the revenue growth rate from 2015 to 2020. Notice there were five full years from the end of 2015, when the revenue was reported, to the end of 2020, when the last revenue data was obtained. Consequently, n = 5.

Revenue growth rate = ((Revenue2020 / Revenue2015)1/5 − 1) × 100%

Revenue growth rate = ((16,675/ 5,010)1/5 − 1) × 100%

Revenue growth rate = 27.19%

Here you can see a graph indicating the 5 years revenue growth rate:

How to project revenue growth rate?

Similar to the last picture, we can estimate the revenue for 2023 (3 compounding periods more, or n = 3) by using the revenue growth rate. Now, our equation would be like this:

Revenue Growth rate = ((Revenue2023 / Revenue2020)1/3 − 1) × 100%

27.19% = ((Revenue2023 / 16,675)1/3 − 1) × 100%

Revenue2023 = $34,310 million USD.

After obtaining the projected revenue, we can use the price-to-sales ratio and calculate the projected market capitalization value. Thus, we could get a price target for our investment.

Another advantage of learning how to project revenue growth rate is that we can use it in order to find projected earnings by considering an average profit margin. Then, by using the price earnings ratio calculator, we can get a projected price or price target.

Final examples from year 2020

-

What is Tesla's revenue growth?

Tesla, for its 2020 4th quarter, reported a quarter-over-quarter growth of 45.5%. On a year-over-year basis, their 2019-2020 revenue growth was 28.31%. Regarding Tesla's revenue growth rate, they reported a 50.78% revenue growth rate during the last 5 years.

-

What is Apple's revenue growth?

Apple, for its 2021 1st quarter, reported a quarter-over-quarter growth of 21.37%. On a year-over-year basis, their 2019-2020 revenue growth was 5.51%. Looking at Apple's revenue growth rate, they reported a 3.27% revenue growth rate during the last 5 years.

-

What is Amazon's revenue growth?

Amazon, for its 2020 4th quarter, reported a quarter-over-quarter growth of 43.6%. On a year-over-year basis, their 2019-2020 revenue growth was 37.62%. Considering Amazon's revenue growth rate, they reported a 29.25% revenue growth rate during the last 5 years.

In conclusion, the revenue growth calculator is an insightful tool, but it could be way more powerful if it is combined with our vast set of financial calculators.

FAQs

What is a good revenue growth rate?

Many prodigious investors recommend a revenue growth above 15% year-over-year. This means that if your business sold $500 million USD in the first quarter of 2020, it should sell $575 million USD in the first quarter of 2021 at least. If you use our calculator, you will see a growth of 15% between those values.

What is the revenue CAGR?

It is another common way investors call the revenue growth rate. It represents how fast the revenues have been growing for several years. The revenue CAGR indicates whether the business is expanding and taking market share from competitors or, on the contrary, if its sales are getting reduced due to some internal/external factors.

What is a bad revenue growth rate?

The only revenue growth rate that is bad is a negative one. As long as you have a positive revenue growth rate, the company will be growing its sales period by period. However, be cautious; the stock market dislikes decreasing revenue growth rates. Thus, the price may suffer soon.