Annuity Payout Calculator

With the annuity payout calculator you can compute the precise amount of annuity payouts through a given interval to reach a specified future value. Primarily, you can apply the tool to find out the fixed amount of annuity withdrawals that fully deploy a given initial balance over a given time. For example, you can easily find out how much does a 100 000 annuity pay per month or how many annuity withdrawals you can get from a 1 million annuity payout. The Mega Millions Payout calculator also offers an annuity schedule for winnings, you might want to check it out! You can also check out our annuity calculator and future value calculator.

Moreover, you can also compute how long it takes to reach a specific future value by setting a fixed, regular payment.

Read further to learn what is the payout annuity formula, how withdrawing money from an annuity works, what annuity payout options you may find, and what is an annuity fund.

What is an annuity fund? — What is annuity income?

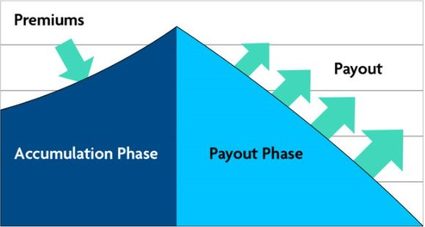

An annuity fund is an investment portfolio that provides a return on the funds (premium) that you pay into an annuity. When the insurance company invests your money into the chosen financial assets, such as stocks and bonds, your money gains interest or a return. Since such institutions invest huge sums of pooled money, they can generate returns large enough to allow them to pay out annuity income streams they guarantee during the payout phase. The guaranteed annuity payments or withdrawals crucially depend on the annuity fund's rate of return and the chosen annuity payout options.

Annuity payout options — Withdrawing money from an annuity

You may choose from multiple annuity payout options accessible on the market, depending on your preferences. You can apply the present annuity payout calculator for the two most common options, namely fixed payment or fixed length.

- Lump sum

The lump sum payout option lets you withdraw the full balance of an annuity in a one-time payment. Such a transaction may incur a financial penalty and income tax.

- Fixed length annuity

By the fixed length payout option, also known as a fixed period or period certain payout, you can set a specific interval over which the annuity payments are guaranteed. For example, an annuitant aged 60 who choose a 20 year fixed-length payout will be guaranteed annuity withdrawals until 80. The potential risk involved in such construction is to choose too short or too long a period.

- Fixed payment annuity

You can set the monthly annuity withdrawals in the fixed payment annuity option, which is guaranteed until the annuity's balance is depleted. Therefore, the annuity payouts' duration depends not only on balance at the beginning of the payout phase and the return rate but also on the amount chosen.

- Life only annuity

What is a life annuity? If you buy a life annuity, you can expect payouts as long as you live. The amount of annuity payments depends on the calculated life expectancy: the longer the life expectancy, the lower the annuity withdrawals. A disadvantage of this annuity payout options is that you cannot choose the payment amount, and there is no guarantee that you will receive the total value of the annuity.

- Joint and survivor annuity

This option is similar to the life annuity option with two main differences. There are multiple annuitants (generally two) involved, and the payouts are transferable to the one who outlives the other. Since, in this case, the life expectancy is determined by all annuitants involved in the transaction, payments will typically be lower than the life only option.

- Life with period certain annuity

This option combines features of the fixed length and life only options. It guarantees annuity payments for life and allows you to set an interval during which the annuity pays a designated beneficiary even if death occurs before the annuity term ends.

How to use the annuity payout calculator

You need to set the following parameters to operate our annuity payout calculator.

- Annuity option — Fixed length annuity / Fixed payment annuity;

- Initial balance — The present value of the annuity, that is, the balance at the beginning of the payout phase;

- Payment frequency — The regularity of annuity payouts;

- Type of annuity — You can choose between an annuity due (beginning of period) or an ordinary annuity (end of period);

- Annuity rate — The interest rate by which an annuity grows each year; and

- Length of annuity — The interval during which the annuity pays out.

Please check out our present value calculator.

Tick the checkbox Set final balance, growth and compounding, and you can reach the following additional variables:

- Compounding method — The frequency of adding interest to the balance;

- Final balance — The future value of your annuity. By default, it is set to zero, which means you completely deplete the initial balance, but you may set this variable otherwise; and

- Annual/periodic growth rate — available for fixed length annuities — This option enables you to set a specific rate of change (increase or decrease) in the annuity payout, so, for example, you can make a cost-of-living adjustment in your annuity.

When you set all the required parameters, you will immediately see the results.

How much does a 100,000 annuity pay per month? — The payout annuity formula

After getting familiar with the annuity payout options, let's demonstrate how you can apply the annuity payout calculator through an example and see how to calculate annuity payments.

To keep it simple, let's assume you would like to compute how many annuity payments you can receive from 100,000 dollars at the end of each month over the following ten years with an annuity rate of 5 percent. To do so, you need to use the payout annuity formula with the following variables:

a = PV / (1 - (1 + i / k)⁻ⁿ×ᵏ) / (i / k),

where:

- a — The regular withdrawal, i.e., the amount you take out each month;

- PV — The initial balance or principal ($100,000);

- i — The annual interest rate (in decimal form, so for the present case, 5% = 0.05);

- k — The number of compounding periods in one year (monthly => k = 12); and

- n — The number of years you plan to take withdrawals (10 years).

a = 100,000 / ((1 - (1 + 0.05/12)⁻¹⁰×¹²) / (0.05/12)) = 1,055.24

Thus, you can withdraw $1,055.24 at the end of each month to deplete your initial $100,000 balance in 10 years.

Disclaimer

You should consider the annuity payout calculator as a model for financial approximation. All payment figures, balances, and interest figures are estimates based on the data you provided in the specifications that are, despite our best effort, not exhaustive.

For this reason, we created the calculator for instructional purposes only. Still, if you experience a relevant drawback or encounter any inaccuracy, we are always pleased to receive useful feedback and advice.